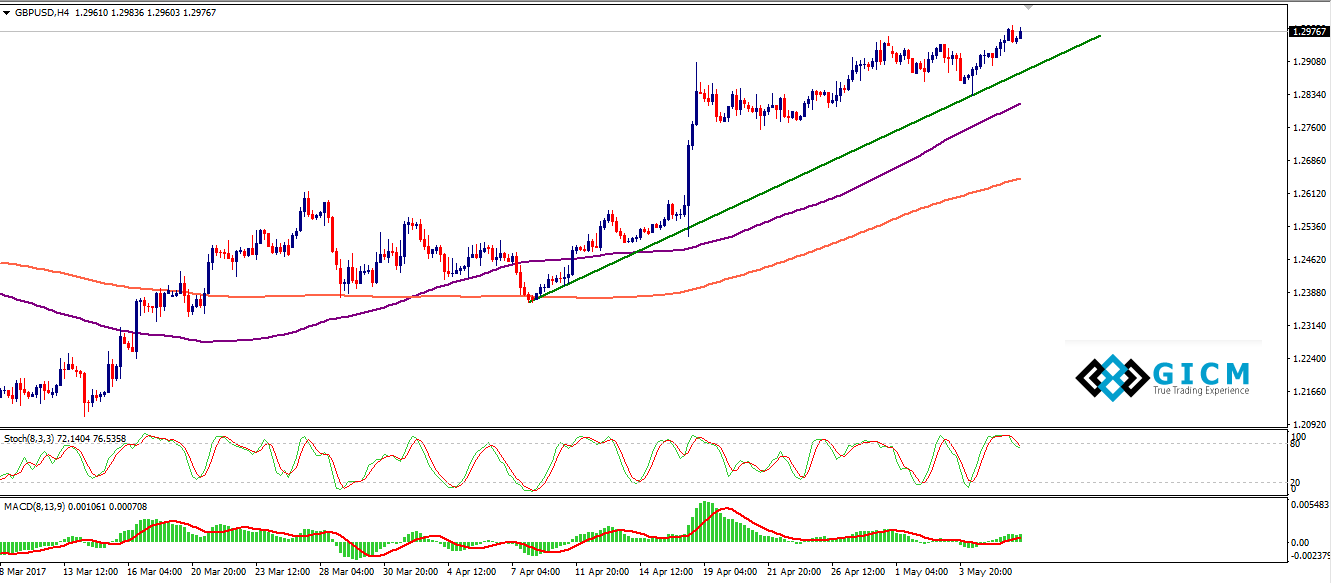

GBPUSD Signals Bullish Continuation

The bulls are seen trying hard to defend 1.2950 levels over the last hours, as the GBP/USD pair consolidates the retreat from fresh seven-month tops reached at 1.2990 earlier on the day.

The spot stalled its last week rally in the Asian opening trades and corrected lower, as markets reacted to the overnight news of a Macron win in the French elections and resorted to unwinding of the Macron trade witnessed over the last month.

Moreover, GBP/USD remains under pressure amid a broadly higher US dollar and positive treasury yields, with investors’ focus now gradually shifting towards a June Fed rate hike, especially after a solid US labour market report released last Friday.

Also, downbeat UK online consumer spending data also collaborated to the downside in the major. Online consumer spending has dropped for the first time in 4 years, data released by payments technology firm Visa revealed.

Moving on, the pound has a big week ahead, with the BOE policy decision and quarterly inflation report (QIR) on tap. Meanwhile, for today, the UK Halifax HPI and US LMCI data will be eyed for fresh incentives.

GBP/USD Levels to consider

A break above 1.2990 (7-week high) could lift the pair above 1.3016 (classic R3), beyond which a test of 1.3050 (psychological mark) is imminent. Conversely, a break below 1.2931 (10-DMA), leading to a subsequent break below 1.2900 (round figure) is likely to drag the pair towards testing its next support near 1.2848 20-DMA).