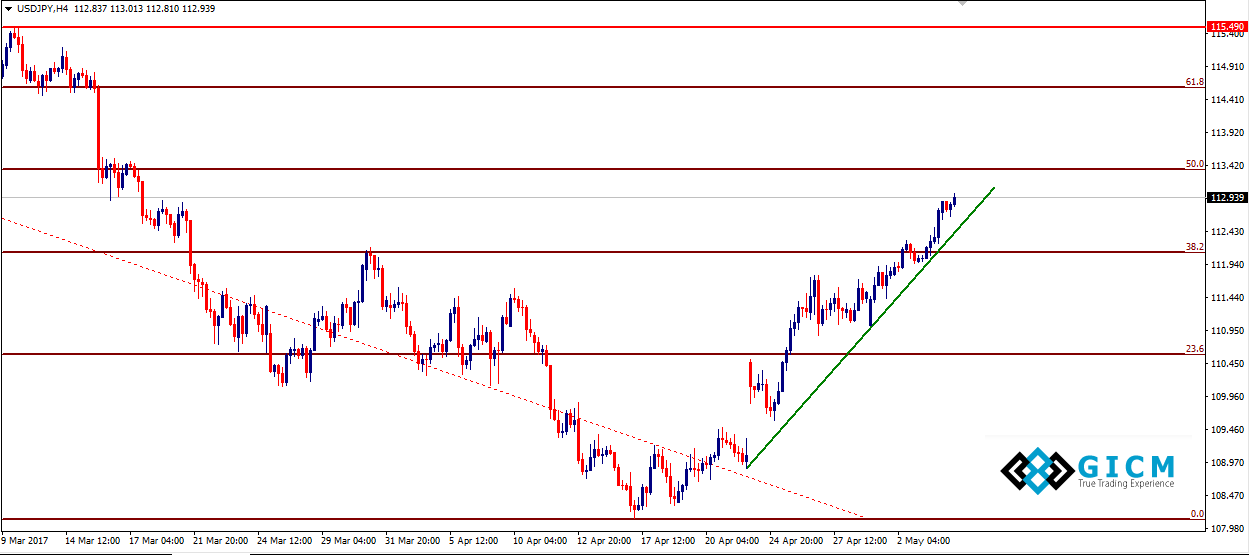

USDJPY: Flying after Breaking Resistance

The USD/JPY pair remains bullish after broken the resistance zone. It is looking for next resistance at 113.40 and fibo 50%. So buyers will look to take their profit on that resistance.

The spot rallied to 112.78 in the overnight trading post the release of the Fed statement and extended gains further to 112.85 this Thursday morning in Asia.

The Fed looks past the first quarter slowdown the economy and acknowledged the continued improved in the labor market and inflation trajectory. The way Fed dismissed the Q1 weakness by calling it transitory boosted market confidence in the US economy and pushed up June rate hike bets to 94% (as per Bloomberg data).

In the meantime, the odds of a June rate hike as represented by the CME data rose to 76%.

The US data calendar is light today with just initial jobless claims due for release. The spot may remain well bid unless European equities turn southwards. Trading activity is likely to be subdued in Asia on account of the trading holiday in Tokyo.

USD/JPY Technical Levels

A break above 113.00 (zero levels + key trend line hurdle) would mark an end to the sell-off from 118.66 (Dec high) and open doors for 113.99 (23.6% of 2011 low – 2015 high) and 114.75 (Mar 3 high).

On the downside, breach of support at 112.59 (session low) would expose 112.18 (5-DMA) and 111.68 (50-DMA).