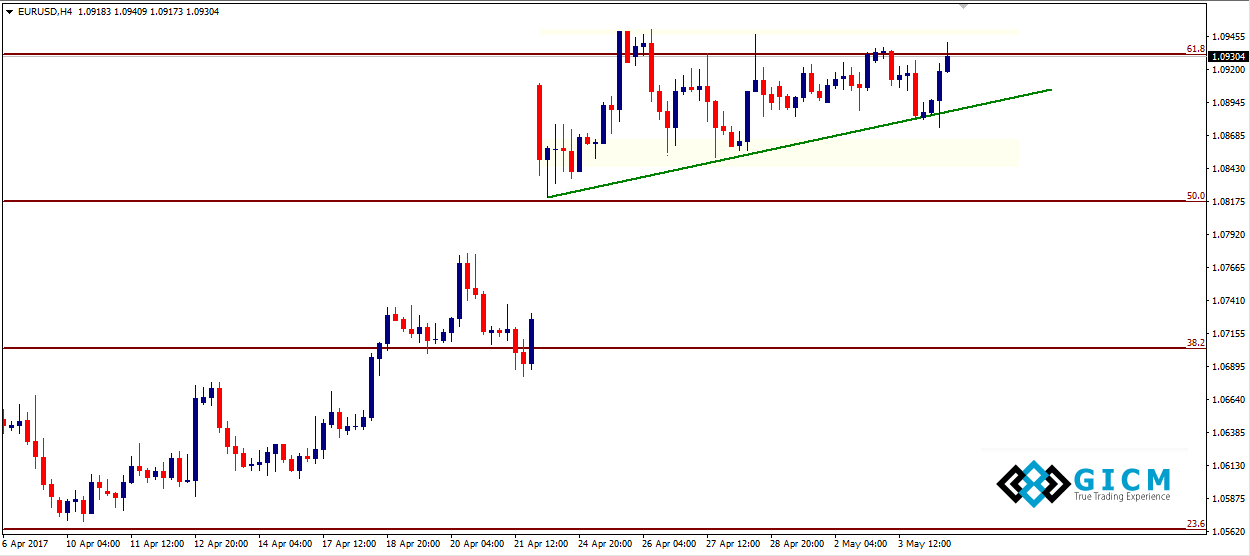

EURUSD: Bounce Back After Bearish Engulfing

Eurusd has pulled back after daily bearish engulfing pattern due to FOMC effect. Near term resistance lies on 1.0950 level. Breakout of this level can bring this pair upto 1.1000 resistance level which can be strong level for this pair.

Focus on Friday’s payrolls & wage growth numbers

The Fed statement cheered the continued strength in the labor market despite slowdown in the first quarter. This has put the focus back on the NFP. A combination of strong payrolls and wage growth figures could yield another leg higher in the USD ahead of the French elections.

Caution ahead of French elections could keep USD well bid

According to a snap opinion poll by Elabe for BFMTV 63 per cent of viewers found Mr Macron more convincing than Ms Le Pen in the debate. Nevertheless, the caution ahead of the final round of the French elections on Sunday could boost demand for the safe haven treasuries and strengthen the bid tone around the US dollar. We could also see a widening of the Franco-German yield spread, leading to a drop in the EUR pairs.

EUR/USD Technical Levels

The spot was last seen trading around 1.0930. A break below 1.0880 (session low) would open up downside towards 1.0852 (Apr 27 low) and 1.0821 (Apr 24 low). On the higher side, breach of 1.0937 (previous session’s high) could yield a rally to 1.0991 (weekly 100-MA) and 1.1046 (late July low).