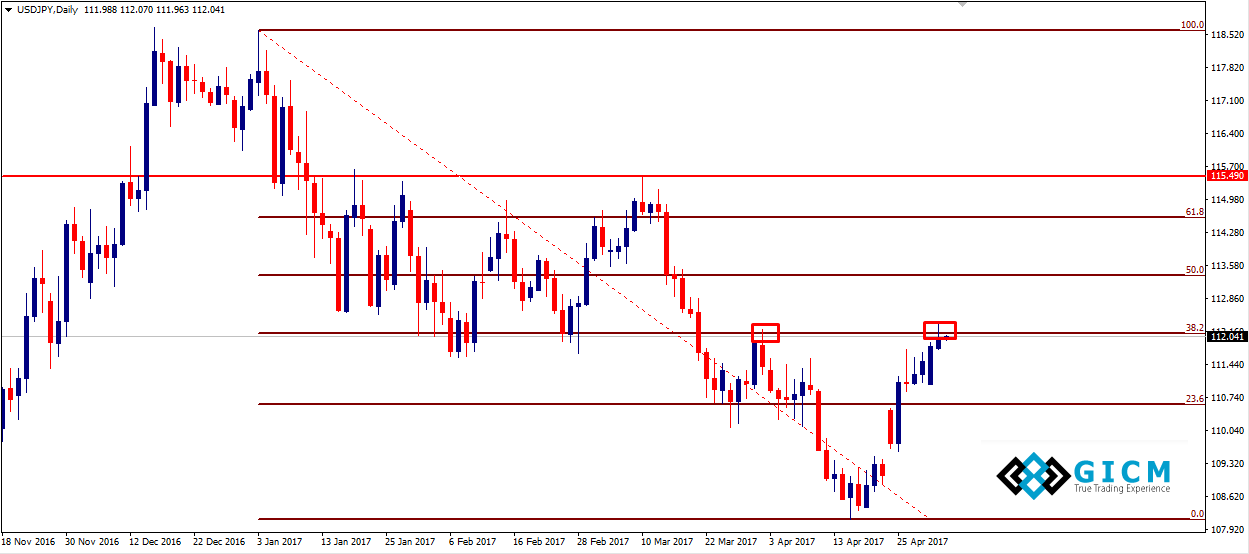

USDJPY: Chipping Away at Key Fibo Resistance Ahead of Fed Decision

The USD/JPY pair is trading just below 112.15 (38.2% fib retracement of 118.66-108.13) this Wednesday morning after having failed to hold above the same on Tuesday.

The spot clocked a high of 112.31 on Tuesday and was last seen trading around 112.05 levels

Eyes FOMC statement

The Fed is expected to keep rates unchanged today. However, investors would scan the policy statement for clues regarding June rate hike and more importantly on whether the central bank intends to begin trimming its balance sheet size this year.

The American dollar would strengthen across the board if the Fed makes a strong case in favor of trimming its balance sheet this year.

The June rate hike probability stands at around 70%, which means the hint of a June rate hike won’t be a shock for the markets, but could result in a dollar rally. The US ISM non-manufacturing and ADP employment report due for release ahead of the Fed decision could move the pair as well.

USD/JPY Technical Levels

A break above 112.15 (38.2% fib) would expose falling channel resistance at 113.25. Only a daily close above the same would signal the bearish trend from 118.66 has ended and could yield a rally to 115.50 (Mar 10 high). On the other hand, a breakdown of support at 111.67 (50-DMA) would open doors for a sell-off to 110.88 (10-DMA) and 110.11 (Mar 27 low).