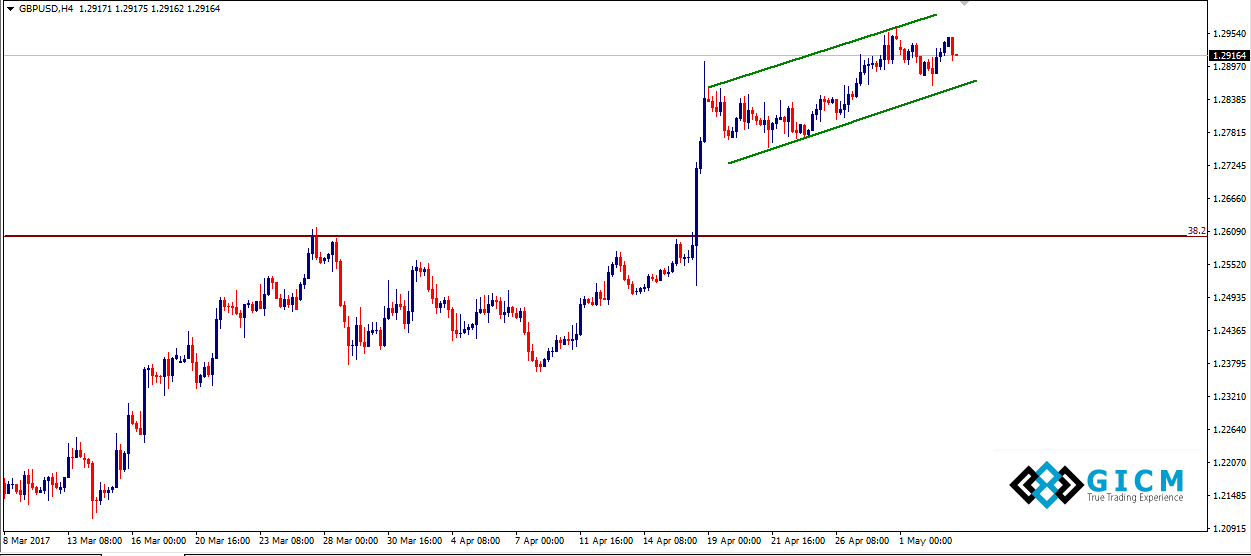

GBPUSD: Targets Ahead of FOMC

The GBP/USD pair built onto yesterday’s recovery gains beyond 1.29 handle in Asia, now looking to regain 1.2950 barrier amid a broadly subdued US dollar and moderate risk-on.

The spot finds support from upbeat UK fundamentals, after yesterday’s sharp rise in the manufacturing PMI data, while the latest BRC shop price index data showed that the shop price deflation in April was the smallest in nearly 3-1/2 years, which keeps the sentiment buoyed around the GBP.

However, over the last hour, the spot is seen consolidating the overnight rally as the ongoing US dollar selling appears to have stalled, as markets brace for the FOMC decision due later tonight.

Focus now shifts towards the next economic data lined up for release from the UK docket for next push higher towards multi-month tops of 1.2970 en route 1.3000. The UL construction PMI data for April is expected to arrive at 52.1 versus 52.2 previous. However, a positive surprise cannot be ruled out after yesterday’s stellar manufacturing PMI report.

Also, the US ADP jobs and ISM services PMI reports will also have a significant impact on the spot ahead of the Fed outcome.

GBP/USD Levels to consider

A break above 1.2955 (May 1 high) could lift the pair above 1.2970 (7-month tops), beyond which a test of 1.3000 (psychological levels) is imminent. Conversely, a break below 1.2900 (round figure), leading to a subsequent break below 1.2886/84 (10-DMA/ Apr 28 low) is likely to drag the pair towards testing its next support near 1.2832 (classic S2/ Fib S3).