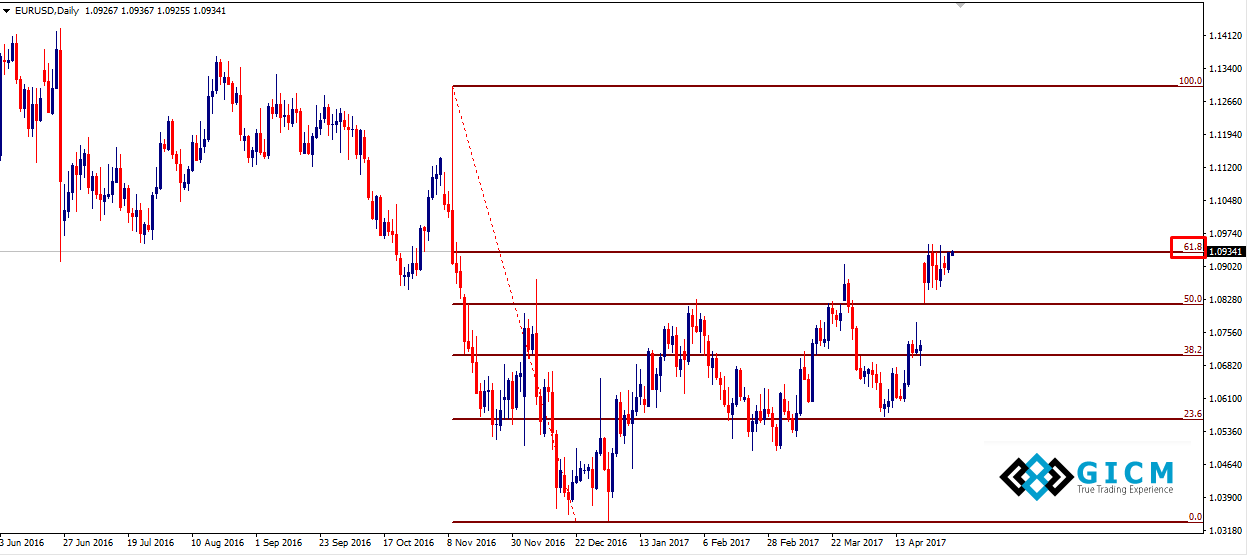

EURUSD: Struggling to Break Resistance Level

The EUR/USD pair found takers at 50-DMA level of 1.0888 in Asia. The trend line sloping downwards from Apr 2016 high and Nov 2016 high is seen offering resistance around 1.1020. A break above the same would signal the sell-off from April 2016 high of 1.1616 has ended i.e. trend reversal.

Eyes FOMC statement

The break above the trend line depends on the tone of the Fed policy statement. The CME data shows the June rate hike probability stands at 70%. This means a hint of a June rate hike would not shock markets, but nevertheless could yield a US dollar rally.

However, the odds of the pair taking out the trend line hurdle at 1.1020 would drop sharply if the Fed statement talks about the scope for reduction in the balance sheet this year.

An uptick in the preliminary Q1 GDP could push the spot higher to 1.10-1.1020 levels; however, a sustained break above the key resistance depends on the Fed’s tone.

EUR/USD Technical Levels

The pair was last seen trading around 1.09235. Multiple resistance levels are seen in the range of 1.0991-1.1020 (1.0991 is 10-DMA), 1.10 is zero figure, 1.1020 is the trend line hurdle). A daily close above the same would open up upside towards 1.1252 (Aug 2016 low).

On the other hand, a breakdown of support at 1.0888 (50-DMA) would expose 1.0750 (5-DMA) and 1.0723 (10-DMA).