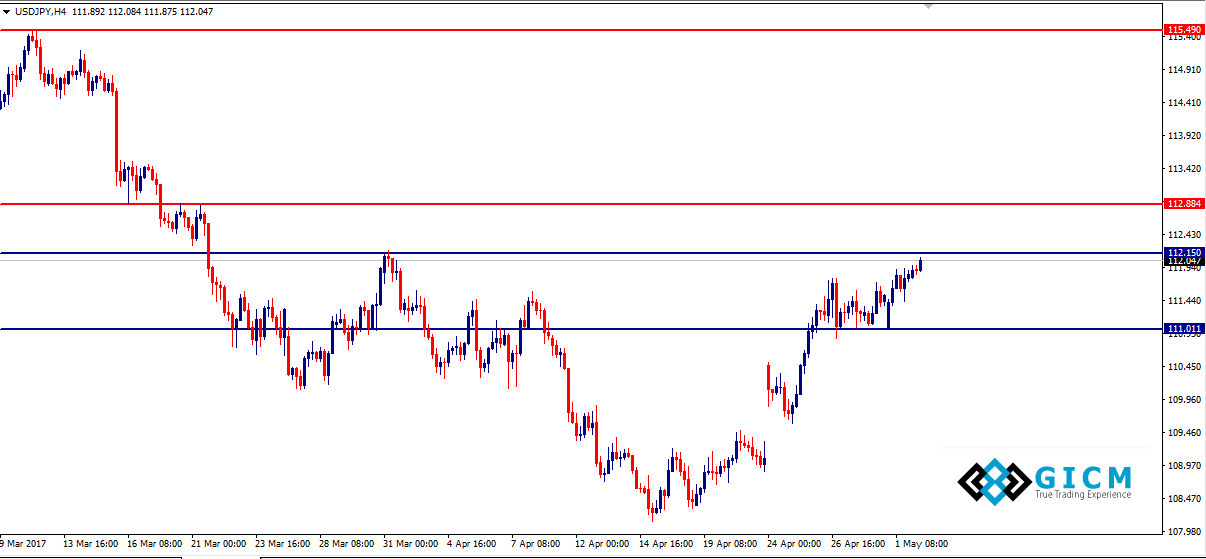

USDJPY: Fighting to Break Resistance

The USD/JPY pair prolonged its recent recovery move and traded with a mild positive bias for the fourth consecutive session, albeit continued with its struggle to break through the 112.00 handle.

The prevalent positive sentiment surrounding Asian equity markets, with Japan’s Nikkei 225 gaining around 0.70%, was seen weighing on the Japanese Yen’s safe-haven appeal and helped the pair to build on to its recent gains. The pair, however, remained capped below the 112.00 handle amid subdued US Dollar price-action, always against the backdrop of recent disappointment from the US macro data.

The pair’s range-bound move on Tuesday could also be attributed to nervousness ahead of the next big event risk – FOMC decision announcement on Wednesday. Although the Fed is widely expected to maintain status quo, but the accompanying statement might provide clues over the central bank’s monetary policy outlook and eventually provide fresh impetus for the pair’s next leg of directional move.

Later during the week, the keenly watched monthly jobs report from the US (NFP) would also play an important role in determining the pair’s near-term trajectory and hence, investors seemed to wait on the sideline before committing to any near-term direction.

With an empty US economic docket, the pair remains at the mercy of broader market risk-sentiment and the greenback price-dynamics.

Technical levels to watch

Immediate support is pegged near 111.70 level, below which the pair could drift back to 111.30-25 intermediate support ahead of the 111.00 handle.

On the upside, momentum beyond 112.00 handle is likely to get extended towards 112.20 level (March 31 high) en-route 112.65-70 horizontal resistance.